Commercial | September 2020

Dos and Don'ts for leasing or buying a CRE property

Buying or leasing a CRE property is a big decision. It is strikingly different than buying a residential property, as there are many factors that come into play in case of a CRE. One needs to understand various terms, the lease structure, due diligence procedure, cash flow models, and much more. It’s not a piece of cake and requires a lot of conscious efforts.

It may get confusing in deciding what to ensure and what to avoid. Hence, here is a quick guide of some basic Do’s and Don’ts of leasing or buying a CRE property. Let’s have a look.

The DOs

- Demand vs Supply

Understanding the CRE market is one of the first things to analyze for a savvy investor. The demand-supply cycle of office spaces plays a major role in the lease or purchase amount. Every city has its hotspots or micro-markets for CRE, for instance, according to Economic Times, ORR, Whitefield, Electronic City in Bengaluru and BKC, Nariman Point and Parel in Mumbai. Now each of these micro-markets has their office stock, i.e., number of offices and upcoming new office spaces. And the annual office space demand is published regularly by companies like JLL, Cushman, and Knight Frank. Keep an eye on both these statistics.

If the supply of offices in prime cities and locations is anticipated to be more in the upcoming few years, then the rent will come down, and vice versa. Hence, it is important to learn to analyze the CRE market and take decisions accordingly for an ideal deal.

- Due diligence

Thorough due diligence is very crucial and imperative for any CRE investment. Making a deal in haste should be the last thing for anyone. One should take time to ensure all the bases are covered before deciding on any property. Checking for everything - from major factors to minute details is important like:- Thorough market research to shortlist the viable options

- Preparing a list of factors to observe each property individually

- Assessing the premises meticulously and ensuring the neighbourhood is good and has access to amenities. Property conditions should be checked too. Does it require maintenance? Is it too old to be leased or bought? The premise defined in the lease should match the expectation. There should be no space for ambiguity.

- Paying attention to the investment amount and analyzing the breakdown. The yearly increment procedure should be clear to avoid disputes later.

- Understand the lease

Leasing a property entails a lot of clauses with it, the most important ones being the lease tenure and amount. As per Economic Times, there are two different lease structures in India, based on the leasing period - 3+3+3 or 5+5+5, i.e. 9-year (or 15-year). Then there’s a lock-in period during which the tenant cannot vacate the property. So understanding the lease structure and the risks involved is important from an investor’s perspective. Hence, it is extremely important to read the lease thoroughly.

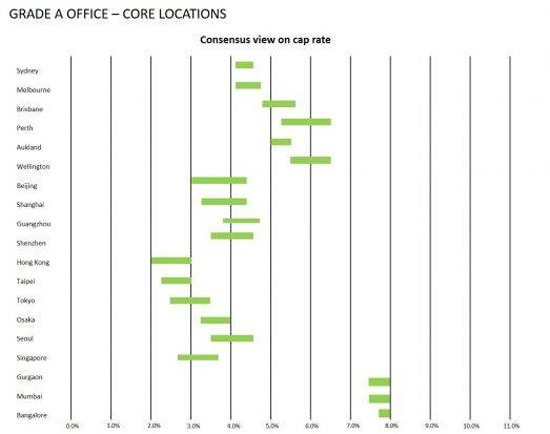

- Capitalization rate

According to Investopedia, Capitalization Rate or Cap Rate is the rate of return on any CRE investment. It is calculated as Net Operating Income of the property / its Current Market Value. Cap rate is important while investing in commercial property as it is useful in comparing the values of similar property investments.

As per the Financial Express, In India, cap rates are around 8-12% depending on the quality of the property and the tenant. The table from a CBRE report shows the cap rate across various countries.

The Don’ts

- No investment strategy

A sound investment strategy is a must for leasing/buying a CRE property. From setting a budget to having an exit strategy, everything must be laid out in advance. Not having a proper planning plan may create havoc later, in case things don’t turn out in favour. Also, ensure an exit strategy that includes time taken to close the deal, money made or lost, access to profits, etc. In fact, JLL advises strategizing in such a way that one should stand in the profit position from an updated lease agreement. A strategy without investment boundaries may lead to significant overspending of money into it than initially decided. Hence, never initiate a deal without a strategy in place.

- Acting alone

Buying or leasing a CRE property involves a multitude of factors. Although one may know the market inside out, it may be possible to miss out on certain factors that may either affect the budget or land a bad deal. Hence, it’s always a wise step to take professional assistance in such decisions. Hiring an expert makes the process easier and hassle-free as they know what to look for, what to avoid, and how to crack the best deals. Their expertise will be an invaluable resource for the buying process.

- Ignoring the hidden charges

In a CRE investment, there’s much more than what meets the eye. The finances are not only about paying lease/buying amount and getting ROI. In fact, a report highlighted by a Workplace Insight hints that the rental amount of office space only accounts for 35% of the total cost of the office space. There may be a lot of hidden fees and charges in the terms and conditions like statutory and local taxes, impending repairs, building insurance, etc. These expenses might be the seller’s responsibility but the buyer/tenant may end up paying for them if not heeded. Hence, one must always be alert while reading the deal terms and look for any expense that raises a red flag.

- Focussing only on ROI

ROI is the major factor any investor looks at. It becomes the major deciding factor for most of the investments. Although it is critical, it should not be a limiting factor for a CRE investment. For any commercial property, there are many other financial aspects to look for, like cash flow, property appreciation, and equity to be gained on paying off the mortgage, etc. Taxation is also a great deal for CRE properties, as tax benefits can be huge in CRE. Hence, a broader scope of returns and profits should be kept in mind.

CRE investment may be complex, but keeping these things in mind will help a great deal in making the entire process a lot easier. As said, it’s always a good decision to hire an expert for such deals. A deal should never be made in haste and enough time should be taken to convert a deal into the best one.